The capital structure or “capital stack” as it is often called, is an important concept to understand when evaluating a construction project because it describes where the money comes from and goes to when financing a project. In this article, the capital structure will be described in the context of a residential building construction loan, the main type of project financing that Morrison Financial Mortgage Corporation focuses on. Similar concepts apply to other forms of project finance.

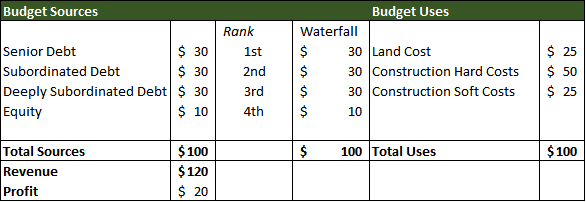

The capital structure describes the composition of the various forms of capital that, in aggregate, need to be in place to fund a project budget. A statement called the Source & Use of Funds must show the total sources of funds to be used in the project equal to the total uses (the project budget). The Source & Use of Funds statement is a useful way to illustrate the priorities under which repayments are made to the various sources of funds. The priorities determine the risks associated with the various sources of capital. An example of priority of payment (in order from first to last) would be: (1) senior debt, (2) subordinated debt, (3) deeply subordinated debt, (4) equity and (5) profit. Debt is borrowed money to be repaid, plus interest, whereas equity is money raised by selling interests in the project’s profit.

Often, the capital structure becomes complicated. There can be various forms of debt, all of which bear different interest rates and different risks. Any of these sources of capital may be secured by a mortgage and thus referred to as “a mortgage”. The fact that an investment is secured by a mortgage does not address where it sits in the priority of repayment, and consequently, how secure it is. If an investment is secured by a mortgage, it does not necessarily mean that it is debt. Equity can still be secured by a mortgage charge and is considered higher risk than the debt obligations ahead of it in rank.

The Waterfall

When there is more than one mortgage registered on title to a property, their priorities respecting repayment are ranked based upon the timing of such mortgage registration. This rank may also be modified by an intercreditor agreement between the parties. In other words, senior ranked mortgage debt principal and interest gets repaid first, then subordinate ranked debt principal and interest get repaid according to rank and otherwise by agreement. Payment rules define the priority of capital repayments to investors at the time of a liquidity event. This is referred to as the repayment waterfall. Understanding these priorities is fundamental to understanding the risks associated with each component of funds within a capital structure.

For example, upon successful completion of a project, the revenue from the project gets applied in the following order of priorities. A typical repayment waterfall is as follows:

- First, to repay principal and interest of $30 to the senior debt lender;

- Second, to repay principal and interest of $30 to the subordinate debt lender;

- Third, to repay principal and interest of $30 to the deeply subordinate debt lender;

- Fourth, to repay $10 to the equity investor; and

- Finally, to pay $20 in profit in accordance with agreements.

This example assumes that a profit is indeed realized in accordance with the business plan and budget. We know this does not always happen, either because of a cost overrun or a revenue deficiency.

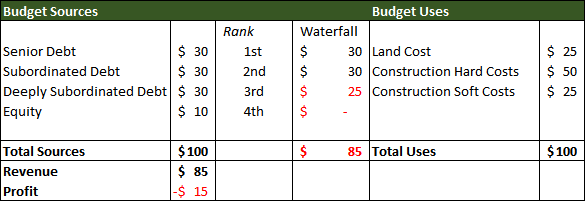

If instead of generating a profit of $20, the project realizes a loss of $15, the project revenue gets applied in the following order:

- First to repay principal and interest of $30 to the senior debt lender;

- Second to repay principal and interest of $30 to the subordinate debt lender; and

- Third to repay principal and interest of $25 to the deeply subordinate debt lender, which depletes all revenue. This results in a loss of $5 to the deeply subordinate debt lender and a total loss of equity for the project sponsor.

It is evident from this example that understanding the repayment waterfall is critical to assessing the risk of repayment of a mortgage.

Liquidity Requirements

Any repayment of debt requires a liquidity event, and in construction loans, are typically one of the following:

- In a construction project of condominium or freehold dwelling units, liquidity comes from the sale of completed homes;

- In a construction project of residential rental units, after they are completed, occupied and rental income is normalized, liquidity typically comes from proceeds from term debt, often provided by Canada Mortgage and Housing Corporation (CMHC);

- For pre-construction land loans, liquidity relies on proceeds from first advance of a construction loan; and

- When available, liquidity may come from refinancing of debt by another party.

All exit strategies describe how liquidity will be achieved.

Cost Overruns

At the beginning of a project, the sponsor presents a project budget. In the event of a cost overrun, however, the capital structure and budget must be modified. The first source of capital in the event of a cost overrun is for the project sponsor borrower (equity participant) to meet a cash call with the injection of true equity or cash. Their ability to do so depends on liquidity and creditworthiness. As detailed in intercreditor agreements, the borrower may have the right to increase the size of certain capital tranches (the sources) in priority to others to meet the cash call. If so, junior tranches may get “pushed down” the capital structure, which means that their claim on repayment would become increasingly subordinated. The project may also have sufficient profitability to attract additional capital in subordinate rank. This could take the form of the addition of deeply subordinated debt.

Creditworthiness of the project sponsor, intercreditor agreements respecting priority of additional capital that may be required, and project profitability must all be considered when assessing the risks of a mortgage.

In conclusion, it is important to understand the proposed capital structure of the project; learn where the proposed investment ranks within the capital structure; assess where funds will come from in the event of a cost overrun; and understand the proposed exit strategy that will create the liquidity event.

Questions or comments?

Graham Banks, CFA, is Senior Vice President, Morrison Financial Services and can be reached at gbanks@morrisonfinancial.com