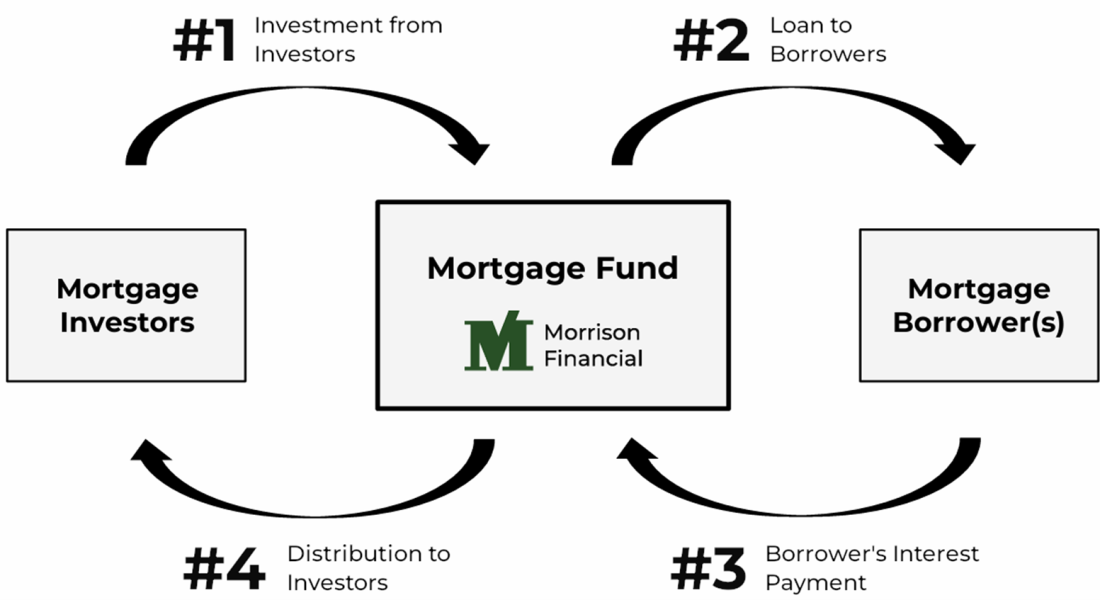

Mortgage investing or private lending is an established strategy typically used by institutions and high net worth individuals to grow their wealth. However, this strategy used to be capital intensive, as mortgage loans are typically a few hundred thousand or million dollars in size, and it also requires certain expertise to be successful. Today, mortgage investing has become significantly more accessible for everyday investors – thanks to investment vehicles like mortgage funds and mortgage investment corporations (referred collectively in this post as a “mortgage fund” or “mortgage funds”). Mortgage funds enable hundreds of investors to pool their money together and invest in a portfolio of mortgages that is managed by finance experts. This makes mortgage investing less capital intensive and enable diversification. Additionally, everyday investors can generate return passively by relying on the fund manager’s expertise to source and manage loans. Let’s discuss how a mortgage fund generates returns to investors in greater detail.

#1 Investment from Investors

Many mortgage funds accept both non-registered investment (i.e. cash) and registered investment plans (i.e. TFSA, RRSP, RESP). Investment from a registered plan is typically recommended for tax advantage purposes. Non-registered investment is held directly by the fund manager* and registered investment is typically held by a registered investment custodian. For reference, a registered investment custodian is a financial institution like a bank or trust company. At Morrison Financial, we work with custodians such as Olympia Trust and Questrade to hold registered accounts for our individual investors.

* Note that the term “fund manager” in this article refers to all parties and entities that may be involved in the management of the fund operations and the loans.

#2 Loan to Borrowers

A mortgage fund manager oversees the origination and underwriting of loans in accordance with the fund’s investment policy. Different mortgage fund or investment corporation will have their own investment criteria depending on the fund’s risk profile, target returns, and the manager’s expertise. As an example, Morrison Financial’s mortgage income funds focused on development and construction loans for residential purposes as this is an area that Morrison Financial has decades of experience in. After a loan is originated and underwritten, it would then go through a comprehensive credit approval process and subsequently legal implementation before any money is advanced to the borrower.

#3 Interest Payment from Borrowers

On a monthly basis, the mortgage fund manager pulls interest payments from its borrowers. In the unlikely event that a borrower is unable to make the interest payment, the fund manager would take on the responsibility to rectify any issues in a timely manner. Should the manager deem that the issue cannot be satisfactorily resolved, the loan would be put into default and enforcement actions will be taken to recover the principal loan as well as any unpaid interest.

#4 Distribution to Investors

Interest collected from the borrowers, net of management fees and expenses, is paid to investors on a monthly basis. For reference, management fee for a mortgage fund or mortgage investment corporation is typically around 1% of net asset value, and fund expenses may include but not limited to legal and regulatory fees, accounting and audit fees, banking and administrative fees.

The distribution date typically occurs around middle of the subsequent month to allow time for administration and processing. Morrison Financial Mortgage Income Funds offer the option for investors to re-invest their monthly distributions through a distribution reinvestment plan (DRIP). DRIP is particularly a great option for a mortgage fund as the investment can compound on a monthly basis.

As outlined in this article, the structure of a mortgage fund is highly transparent and easily understandable by anyone. The investment return is simply generated from lending activities rather than speculation on future business or real estate values. At Morrison Financial, our priority is to protect our investor capital and to become a reliable source of passive income for the long run.

Morrison Financial is one of Canada’s longest-standing private real estate finance firms. During its 38 years in business, Morrison Financial has advanced over $1.6 billion in loans. Morrison Financial operates two mortgage income funds which invest in a diversified portfolio of short-term residential development projects across Ontario, and its trust units are eligible to be held in registered accounts. Morrison Financial has retained Belco Private Capital as its exempt market dealer. Contact us to schedule a time with one of the dealing representatives to determine whether this investment is suitable for you.

Written by:

Chawin Vajanopath, MBA, Senior Director of Operations

Ryan Tan, Business Development Intern