Traditional investment theory has investors dividing their portfolio into two broad categories: equity and fixed income. Equity offers potentially higher rates of return in exchange for the acceptance of higher volatility, or higher risk. Fixed income provides lower returns in exchange for lower risk. A well constructed portfolio will be diversified to include both debt and equity components. This basket of securities should be designed to provide a risk and return profile that is consistent with each investor’s overall risk profile.

Let’s consider the key objectives and constraints:

- Risk objectives: What is your willingness to lose money?

- Return objectives: What returns do you seek, both on an absolute basis and relative to other assets in the portfolio?

- Liquidity requirement: When will you need the cash?

- Time horizon: Are you at a life stage when you can recover from a material loss?

Other investment components to consider are tax implications, legal and regulatory issues, and other unique circumstances.

As investors age, their willingness to lose money may diminish and so they may accept lower returns as a trade-off to reduce risk. Their time horizon becomes shorter and often their ability to recover from a loss is diminished. This calls for an increase in allocation to fixed income instruments.

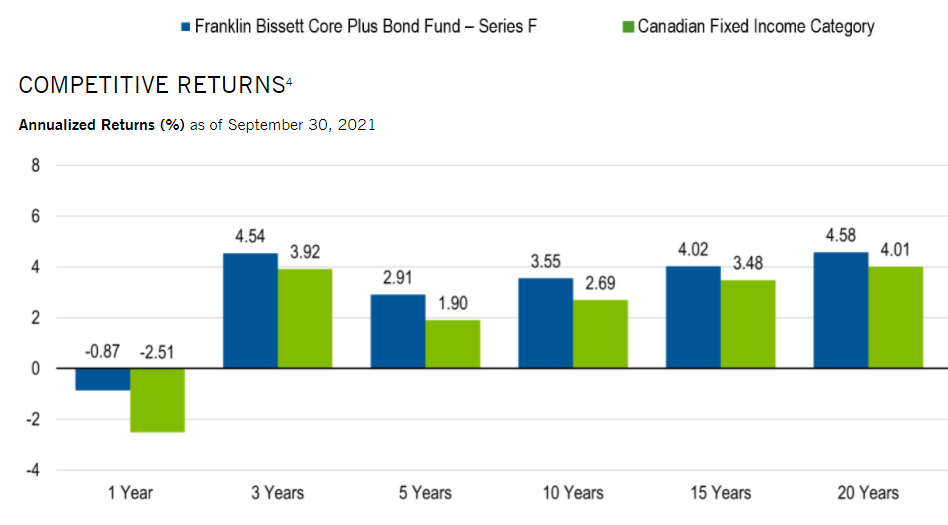

Increasing traditional fixed income securities in a portfolio can decrease total portfolio returns. For example, an exchange traded fund (referred to as an ETF), the Franklin Bissett Core Plus Bond Fund, comprised of investment grade bonds, has returned less than 3% per annum over the past five years.

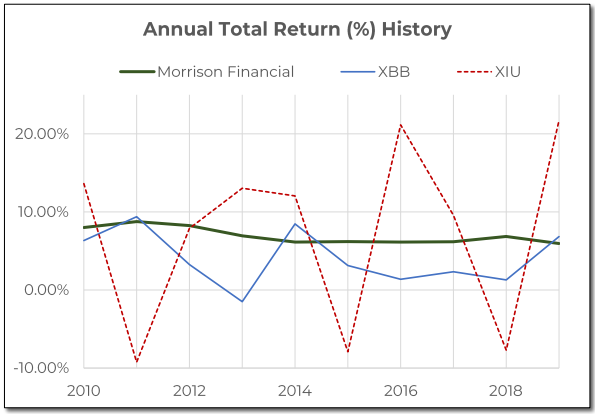

In contrast, private mortgages and other alternative investment strategies, are often designed to deliver returns in the 5% to 10% range per annum, sometimes more. For example, investors in a basket of private construction mortgages managed by Morrison Financial Mortgage Corporation provided consistent and stable annual returns in the 6% to 8% range over a ten-year period.

This graph compares historical returns of a Morrison Financial mortgage portfolio to those of:

- The XBB, an ETF replicating a portfolio of publicly traded Canadian bonds; and

- The XIU, an ETF replicating a portfolio of publicly traded Canadian equities

However, investing in private mortgages is not without risk. In Canada, we can participate in private mortgages either by investing in a fund that holds a basket of these mortgages, or by participating in a single mortgage though syndication arrangements. Either way, two things should happen:

- The investment manager has a responsibility to describe the nature of the investment in sufficient detail to prospective investors that it will enable them to assess the risks inherent in the investment; and

- as an investor in private mortgages, it is your responsibility to understand the underlying mortgage investment, either by yourself or with counsel from an advisor.

Morrison Financial recommends taking the time to read the material provided by the investment manager, especially their investment policy statement. Talk directly to the investment manager. Do whatever is necessary for you to understand the investment managers’ competence in sourcing, structuring and the ongoing management of the investment, or portfolio of investments. Key questions to ask are as follows:

- What are the loan-to-values of the investments? That is total debt on the property divided by its value, aka, LTV.

- How are the LTVs substantiated? Be sceptical of property appraisals. Are the underlying assumptions realistic?

- What is the length of time to loan repayment? What are the loan exit strategies? Are they clearly defined and realistic?

- If the financing involves a project (this could be a construction project, or a renovation project for example), is there a competent team in place to see it through to completion?

- What is the demand for the projects’ end products? Is the end-user market large enough and robust enough to absorb these products?

- In the event of cost overruns during the project, will the borrower have sufficient cash to fund them?

- What are the manager’s strategies to manage these risks in the event of non-performance of a loan?

In conclusion:

- In many cases, private mortgages and other alternative investments provide an attractive risk-adjusted return and can be an appropriate asset class within a well diversified portfolio.

- Private mortgages are not all created equal. You must take the time to study the nature of the underlying investments and assess the manager’s competence in their selection, structure, and management.

Questions or comments?

Graham Banks, CFA, is Senior Vice President, Morrison Financial Services and can be reached at gbanks@morrisonfinancial.com