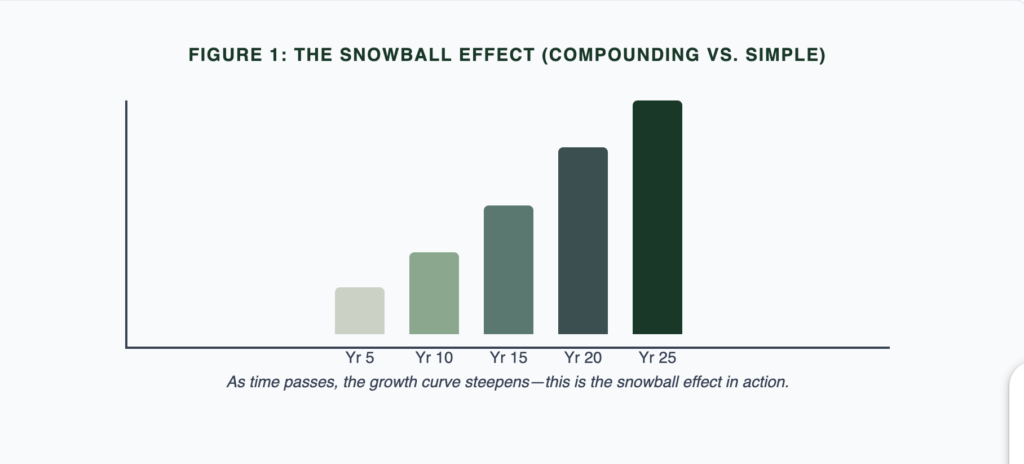

Albert Einstein is often quoted calling compound interest the ‘eighth wonder of the world‘ . The concept is simple in its mechanics, but the long-term outcomes can be profound. Compound interest is the interest you earn on your initial principal and on the accumulated (unpaid) interest during the length of the investment.

Effectively, it is the interest you earn on interest, which can create a snowball effect and dramatically accelerate wealth creation over a long period of time, only when the concept is not interrupted by changes in investment philosophy (i.e., playing the market).

In this metaphor:

The Wet Snow: Represents high-quality investments with strong fundamentals that can continously generate returns, like those from the Morrison Financial Senior and Junior Mortgage Income Funds.

The Really Long Hill: Is symbolic of time. The simple ingredient that allows compounding work its magic.

An investment portfolio can grow to a massive size through reinvestment of earnings over a long period of time, just as a small snowball at the top of a long hill, will be massive in time, when has rolled the entire distance of the hill.

The Rule of “72” is a quick way to visualize the power of compounding. Divide 72 by your annual interest rate return to find the approximate time in years that your investment will double. At a 9% return, your investment will double approximately every 8 years.

To help you visualize these impacts, Morrison Financial has created a compound return investment calculator, which you can access here:

Mortgage Investment Returns Calculator

As a quick example using our calculator, a $100,000 invested at 9% per annum with dividend reinvestment would turn into $600,915 over 20 years. A staggering 500.92% growth on investment! In addition, should you contribute a further $10,000 every year, the final investment can reach $1,121,000! This is a great way to grow your wealth passively over the long-term. Of course, investment returns can fluctuate and past performance is not indicative of future results. However, this example simply helps depict what the snowball effect can look like.

This principal is most effective when combined with a long-term buy and hold investment strategy.

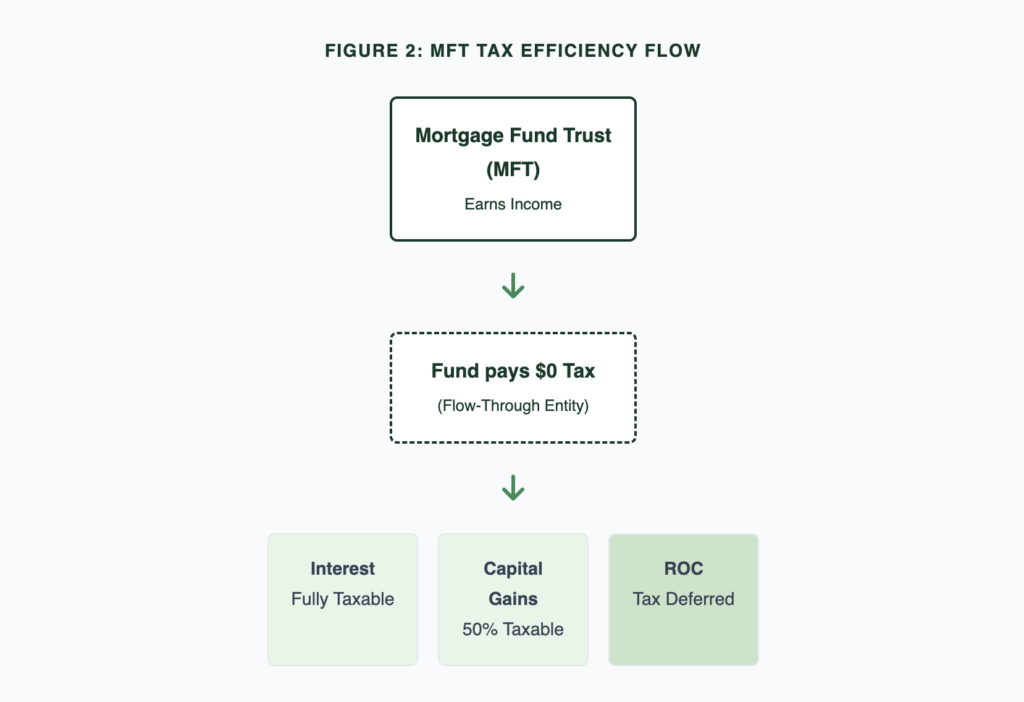

The Mutual Fund Trust (MFT) Structure

Unlike a corporation, an MFT acts as a flow through vehicle. This means the trust itself does not pay income tax, provided that it distributes all of its net income to its unitholders annually.

The tax liability ‘flows through’ to the unitholders (individual investors), who are then taxed on the specific character of the income they receive. Morrison Financial’s Senior and Junior Mortgage Income Funds are structured as MFTs. These funds pool capital from accredited and eligible investors to issue, private short-term mortgages.

For a non-registered account, distributions reported on a T3 slip can comprise different types of income. For the most part, one could expect to report the income received via MFTs as interest income.

Interest Income: The primary income source for a mortgage fund, which is fully taxable at your marginal tax rate.

Capital Gains: If the fund sells a mortgage for a profit, it would be considered a capital gain in this instance. This should not occur very often.

Return of Capital (ROC): This portion is not taxable.

By holding this type of investment in registered accounts like TFSA, RRSP, etc., investors can achieve complete tax free or tax deferred growth. An argument can be made that the least tax-efficient investments should be reserved for registered account investments, allowing an investor to utilize non-registered accounts for more tax-efficient investment.

The Morrison Financial Senior and Junior Mortgage Income Funds accept registered accounts, which generally can be invested through a custodian such as Olympia Trust, Questrade or your portfolio manager.

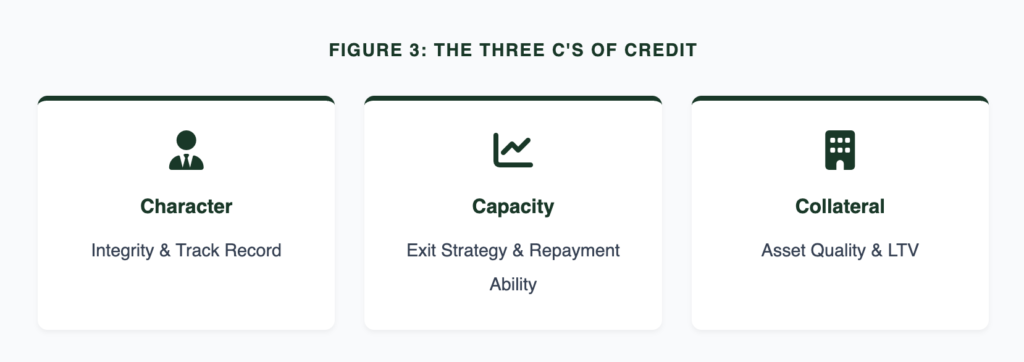

The Morrison Financial Senior and Junior Mortgage Income Funds: A Credit Adjudicator's Point of View

From a credit adjudicator’s standpoint, which is rooted in rigorous due diligence, here are five compelling advantages of investing in a well-managed mortgage income fund. To look at this we will evaluate a few of the C’s of credit.

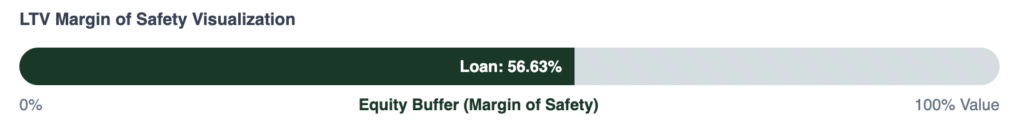

1. Secured and Tangible Asset Class (Collateral)

Unlike stocks, these investments are secured by tangible real estate. The mortgage market, and that of Canada has shown remarkable resilience due to a traditionally conservative lending culture as compared with other comparable jurisdictions. A key metric most will scrutinize is the Loan-to-Value or LTV.

For example, as of March 2025, the Morrison funds reported a weighted average LTV of 56.63%, providing a substantial buffer against market downturns.

2. Consistent and Predictable Income

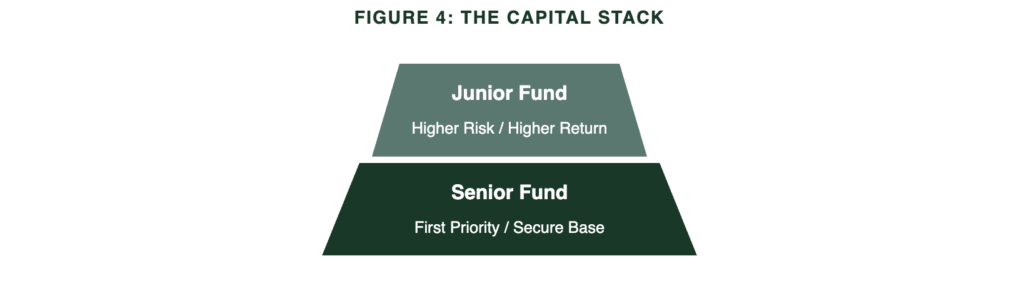

Mortgage funds are designed to create consistent passive monthly income. The Morrison funds offer two distinct risk profiles:

Senior Fund: Target returns of 6.50% to 7.50% (Lower Risk | Lower Return)

Junior Fund: Targeted returns of 8.50% to 9.50% (Higher Risk | Higher Return)

3. Professional Management

Performing due diligence on our borrowers is a meticulous undertaking. We thoroughly assess:

Character: We go beyond a simple credit score to review and scrutinize the integrity of the borrower group, we review experience, project history, and other implications which may be more nuanced than traditional credit protocols.

Capacity: We focus on the ‘exit strategy’. How will the Borrower pay us back? How will the Borrower manage in the event of project delays, increases in costs, and changes in market values.

Collateral: We complete a rigorous evaluation of the project’s intrinsic value. We rely on third-party reports, and perform our own due diligence through primary and secondary research of information that would not be available to the general public to validate or scrutinize those third-party evaluations.

4. Portfolio Diversification

Mortgage income funds provide exposure to private credit, an alternative asset class with low correlation to public stocks and bonds. This can smooth out the average portfolio return during periods of high volatility in the equity markets.

5. Enhanced Returns

By catering to Borrowers that may not fit the strictest of criteria required to Borrower in this category from traditional banks, private lenders like Morrison Financial can command higher interest rates, translating into attractive risk adjusted returns to the investor.

A Credit Adjudicator's View on Risks

It cannot be said that any investment is without risk, and it would not be appropriate to provide the positive aspects of a mortgage investment without weighing and balancing the risks.

1. Liquidity & Opportunity Costs

Investments in a private mortgage fund are not publicly listed securities. Withdrawing funds is subject to terms. At Morrison Financial, we pride ourselves on meeting our redemption queues in as timely a fashion as possible, targeting 30 days, and with a goal to not exceed 90 days for redemption from the date of a request. This makes the investment not suitable for funds which are intended to be used in cases of emergency. This creates an opportunity cost that the investor must evaluate – which is the potential return you forgo by having your investment in a vehicle such as this.

2. Borrower Default and Credit Risk

The primary risk of any mortgage investment is non-payment. While power-of-sale is a remedy, it is costly. Proceeds under these circumstances are used to pay expenses before the lender recovers its capital.

Market downturns can erode the ‘margin of safety’ built into the LTV. This is the reason that Morrison Financial conservatively lends at a reasonable LTV in most all investment instances to protect against investor capital in the case of default. Additionally, Morrison Financial builds a loss reserve account to offset any potential losses that may occur in the funds.

3. Manager Risk

Success heavily relies on the manager’s expertise. A flawed underwriting strategy can lead to losses. Investors must scrutinize the management team and ensure alignment. Morrison Financial has been in continuous operation for more than 38 years, and thus has generated a long-standing track record of investment management.

Disclaimer:

Morrison Financial is one of Canada’s longest-standing private real estate finance firms. During its 38 years in business, Morrison Financial has advanced over $1.6 billion in loans. Morrison Financial operates two private mortgage income funds which invest in a diversified portfolio of short-term residential development projects across Ontario, and its trust units are eligible to be held in registered accounts.

This article is for general information purposes only and does not constitute a solicitation to buy or an offer to sell securities, nor shall it form the basis of an act as any inducement to enter into a contract or commitment. Any offering is made only pursuant to the relevant offering documents, all of which must be read in their entirety. Introductions are permitted exclusively through registered dealers. Morrison Financial has retained Belco Private Capital as its exempt market dealer. Contact us to schedule a time with one of the dealing representatives to determine whether this investment is suitable for you.

Article by:

Matthew Solda, MBA – Vice President